Treasury Secretary Janet Yellen laid out a three-pronged agenda on Wednesday to address what she described as ongoing threats to the nation’s financial system.

Those threats include both disruptions that occurred early in the Covid-19 pandemic as well as more recent developments regarding hedge funds.

Presiding over the Financial Stability Oversight Council, which she now leads but was once a member, Yellen said last year’s market disruptions at the onset of the Covid-19 pandemic could have been worse.

“If not for the swift action of the Federal Reserve, Treasury, Congress and others, those stresses may have led to an even greater economic contraction,” she said. “Indeed, we are digging out of a deep hole now, but we should be mindful that the hole could easily have been deeper.”

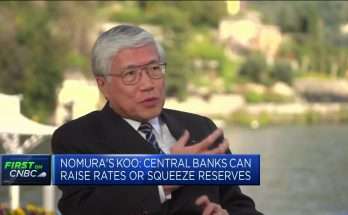

The meeting comes just days after family office Archegos was at the center of a market disruption related to margin calls. Credit Suisse and Nomura warned they would take substantial hits, and shares of ViacomCBS and Discovery got slammed.

A summary from an executive session of the committee said the panel “discussed recent market developments related to hedge fund activities,” though the readout did not mention Archegos specifically.

Mutual funds and climate change

Yellen tasked the council with addressing three areas: Vulnerabilities in money market and open-end mutual funds and other nonbank financial market issues, weaknesses in the U.S. Treasurys market, and dangers that climate change could pose to the system.

One part of that work will entail reestablishing the FSOC’s hedge fund oversight group, which had previously been disbanded.

“The pandemic showed that leverage of some hedge funds can amplify stresses, too,” Yellen said. “This council used to have a hedge fund working group, and as of today we have one again. We’re establishing the working group so that we can better share data, identify risks and work to strengthen our financial system.”

That system locked up last March as the Covid-19 threat turned into a pandemic. A rush for cash among institutional investors clogged what normally are highly liquid short-term funding markets, requiring the Fed and Treasury to work together to stand up multiple facilities aimed at thawing those markets.

Most of those facilities have been shuttered, but the Fed is still buying at least $120 billion of bonds a month in part to ensure smooth market functioning.

On the climate change issue, Yellen reiterated concerns that she has shared on the issue and have been voiced by several Fed officials. The central bank recently has established a pair of committees that will examine what big banks should be doing to brace against climate-related events.

“It’s an existential threat to our environment, and it poses a tremendous risk to our country’s financial stability,” Yellen said.

Other issues she expects FSOC to address include cyber threats, the growing use of non-banks for corporate credit, and the increasing presence of digital currencies.