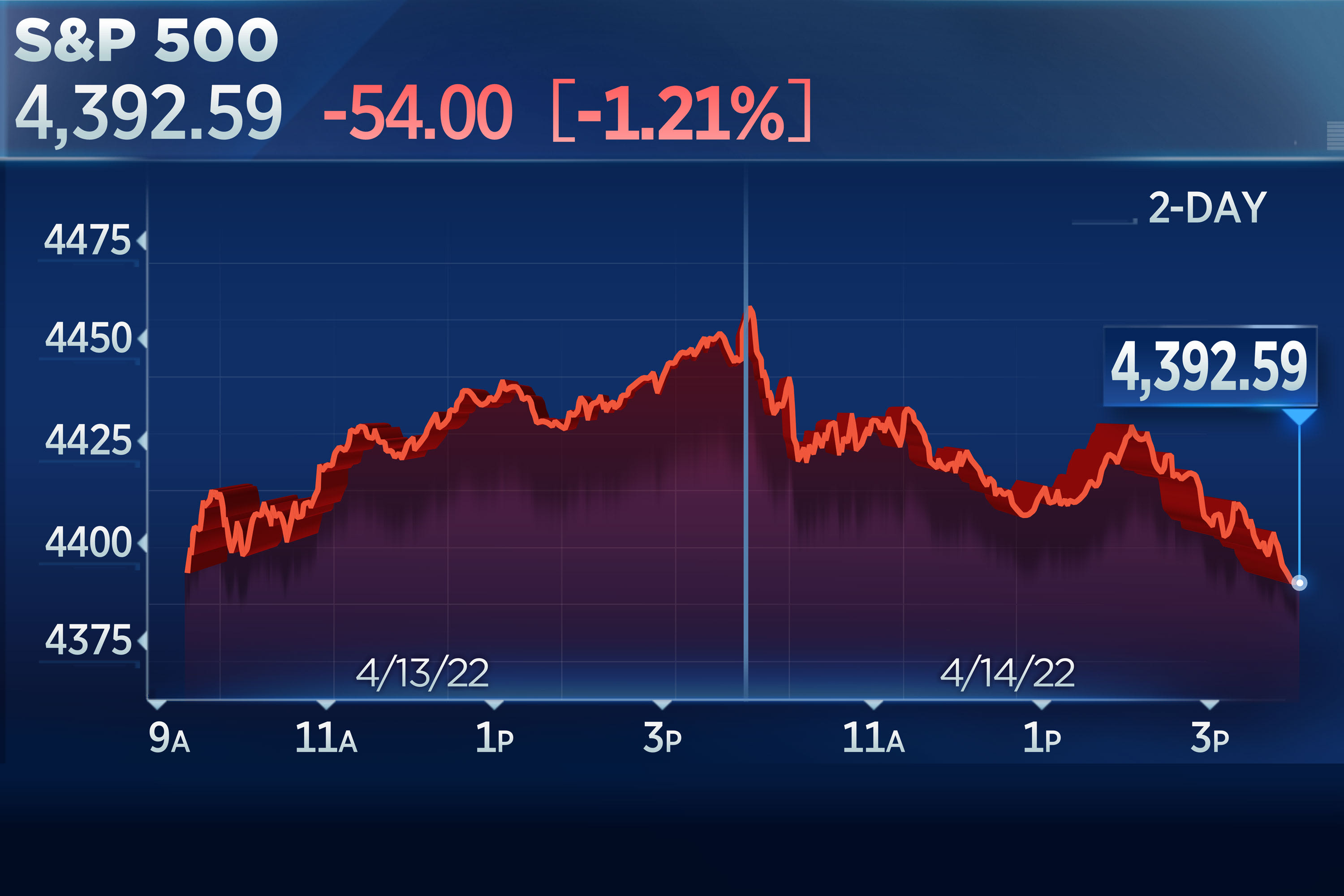

The S&P 500 and Nasdaq Composite fell Thursday, capping a losing week as investors digested mixed earnings results from major banks and rising inflation.

The broad-market index fell 1.21% to 4,392.59, while the Nasdaq Composite lost 2.14% to 13,351.08. Meanwhile, the Dow Jones Industrial Average lost 113.36 points, or 0.33%, to 34,451.23.

The S&P 500 is down 2.13% for the four-day holiday week. The Nasdaq Composite is off 2.63%, and the Dow is down 0.78% for the week. Trading is closed at the NYSE on Friday.

The market’s moves came as inflation took center stage in investors’ minds this week. Treasury yields climbed higher, and two back-to-back U.S. inflation reports showed sharply rising prices. On Thursday, the benchmark 10-year U.S. Treasury yield rose back to multiyear highs, climbing 13 basis points to top 2.8%.

“What’s happening with yields directly impacts stocks at this stage of the game, because it’s just one more of so many other negative data points, or bearish data points, that investors have to deal with,” said Adam Sarhan, founder and CEO at 50 Park Investments.

Loading chart…

On Tuesday, March’s consumer price index reading showed an 8.5% increase from a year ago, the fastest annual gain since December 1981 — and higher than the Dow Jones estimate for 8.4%.

Supplier prices were also hotter than expected for March, gaining 11.2% from a year ago and marking the biggest gain on record going back to 2010.

Inflation fears and higher bond yields drove tech shares lower on Thursday, as investors dropped growth stocks in favor of more stable assets. Microsoft dropped 2.7%, Apple tumbled 3%, and Google slipped 2.4%. Chip stocks also slumped with Nvidia sliding about 4.3%, and Advanced Micro Devices falling about 4.8%.

Further, Elon Musk offered to buy Twitter for $54.20 a share. Musk said this was his best and final offer for the social media company, which he said needs to be transformed privately in order to thrive. Shares of Twitter fell about 1.7%. At the same time, Tesla shares declined 3.6%.

Loading chart…

This week’s reports of rising prices also spurred further speculation on how the central bank might respond.

“I think the data has come in exactly to support that step of policy action if the committee chooses to do so, and gives us the basis for doing it,” Federal Reserve board member Christopher Waller said on CNBC’s “Closing Bell” Wednesday. “I prefer a front-loading approach, so a 50-basis-point hike in May would be consistent with that, and possibly more in June and July.”

For now, investors are weighing the hot inflation data, the Fed’s next steps and first-quarter earnings as they decide how to proceed.

Retail sales figures for March slightly missed expectations with a 0.5% gain, driven by sales at gas stations, according to the U.S. Census Bureau. That’s compared to the 0.6% consensus estimate from Dow Jones.

Jobless claims jumped 185,000 for the week ending April 9, according to data from the Labor Department.

Major banks post mixed results

On Thursday, major banks including Goldman Sachs, Morgan Stanley and Wells Fargo posted their first-quarter earnings, which investors reviewed to see how the banks navigated surging inflation.

Goldman Sachs‘ stock price fell 0.1% after reporting a first-quarter earnings beat. The bank reported per-share earnings of $10.76 on $12.93 billion in revenue. Analysts polled by Refinitiv expected per-share earnings of $8.89 on revenue of $11.83 billion.

Shares of Morgan Stanley popped 0.7% after the bank posted better-than-expected earnings. The firm earned $2.02 per share on revenue of $14.8 billion. Analysts expected $1.68 in per-share earnings and revenue of $14.2 billion, according to Refinitiv. The bank generated stronger-than-expected revenues from equity and fixed-income trading.

On the other hand, shares for Wells Fargo dropped 4.5% Thursday after the bank posted first-quarter revenue that fell short of analysts’ estimates and said credit losses were likely to increase.

“We’re still very early in earnings season, so we still have a lot more numbers to digest, but for now, the market is doing its best to stabilize after a great big sell off,” said Sarhan of 50 Park Investments.

Citigroup, U.S. Bancorp and Ally Financial also reported earnings Thursday.