LONDON — BlackRock CEO Larry Fink is facing calls to step down from activist investor Bluebell Capital over the company’s alleged “hypocrisy” on its environmental, social and governance (ESG) messaging.

Fink has become an outspoken proponent of “stakeholder capitalism” and in his annual letter to CEOs earlier this year, pushed back against accusations that the giant asset manager was using its size to push a political agenda.

However, in a letter to Fink dated Nov. 10, shareholder Bluebell expressed concern about the “reputational risk (including greenwashing risk) to which BlackRock under the leadership of Larry Fink have unreasonably exposed the company.”

In a statement sent to CNBC on Wednesday, BlackRock responded: “In the past 18 months, Bluebell has waged a number of campaigns to promote their climate and governance agenda.”

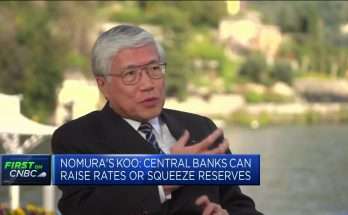

Larry Fink, Chairman and C.E.O. of BlackRock arrives at the DealBook Summit in New York City, November 30, 2022.

David Dee Delgado | Reuters

“BlackRock Investment Stewardship did not support their campaigns as we did not consider them to be in the best economic interests of our clients,” it said.

London-based Bluebell — an activist fund with around $250 million in assets under management that holds a tiny stake in BlackRock — has previously targeted the likes of Richemont and Solvay, and had a hand in successfully forcing a management restructure at Danone.

Partner and co-founder Giuseppe Bivona told CNBC Wednesday that the firm was concerned about “the gap between what BlackRock consistently says on ESG and what they actually do,” based on Bluebell’s encounters with the Wall Street giant during activist campaigns directed at these companies.

“We see BlackRock endorsing a number of bad practices from a governance, social and environmental perspective which is not actually in tune with what they say,” Bivona said.

“In our latest activist campaign at Richemont, they have been opposing the increase of board representation for investors owning 90% of the company from one to three. I really don’t think this is in the best interest of the investor, upon which on a fiduciary basis they invest the money, and of course it’s not in the best interest of any shareholder.”

Bivona also took aim at BlackRock’s 2020 promise to clients to exit thermal coal investments, which it says in its client letter on sustainability that the “long-term economic or investment rationale” no longer justifies.

Bluebell noted that this commitment excludes passive funds such as index trackers and ETFs, which constitute 64% of BlackRock’s more than $10 trillion in assets under management.

The company remains a major shareholder in the likes of Glencore and “coal intensive miners” Exxaro, Peabody and Whitehaven, Bivaro’s letter to Fink on Nov. 10 noted. A report earlier this year found that giant global asset managers including BlackRock were still pumping tens of billions of dollars into new coal projects and major oil and gas companies.

“Let me say that when the price of coal was around $76 per ton, BlackRock was talking about essentially divesting,” Bivona told CNBC.

“Now that the price of coal is $380 per ton, they are talking about responsible ownership. I think there is a high correlation between BlackRock’s strategy on coal and the price of coal.”

Bluebell’s letter also took aim at BlackRock for having “politicized the ESG debate,” after its public advocacy led to a swathe of Republican-controlled U.S. states divesting assets managed by BlackRock in protest at the asset manager’s ESG policies.