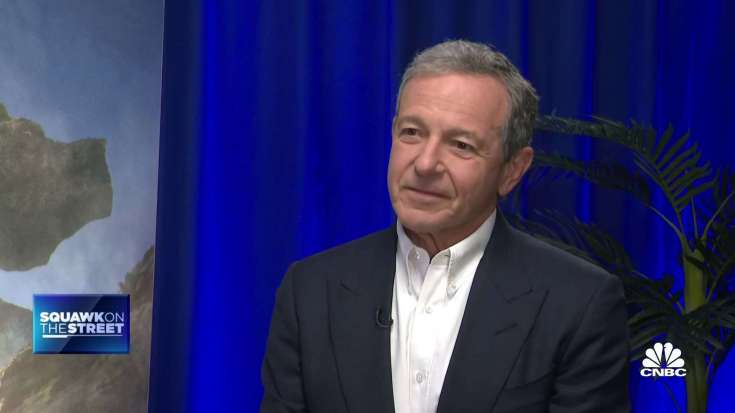

Disney CEO Bob Iger appeared Thursday on CNBC’s “Squawk on the Street” following the company’s announcement it would cut 7,000 jobs and slash $5.5 billion in costs as part of a larger reorganization.

Iger, who returned to Disney’s helm in November, said Thursday he had no intention to stay longer than two years in his post.

“Well, my plan is to stay here for two years, that’s what my contract says, that was my agreement with the board, and that is my preference,” Iger told CNBC’s David Faber on Thursday.

Iger acknowledged he has a lot to do in that short period of time, in addition to helping the board “succeed at succession.” The board ousted Bob Chapek as CEO last year. He was Iger’s hand-picked successor.

“We thought we made the right decision when we chose Bob [Chapek] in 2020. The board decided in November he wasn’t the right person for the job and made a change,” Iger said, declining to comment further on what led to the abrupt departure.

On top of the list is Disney’s streaming strategy and making the business profitable, Iger said Thursday. He called streaming “the future.”

Disney announced this week that as part of its cost-cutting measures, it would slash $3 billion in content costs. Iger’s moves also settled a dispute between Disney and activist firm Trian’s chief, Nelson Peltz.

Peltz called into CNBC immediately after the Iger interview to declare the two sides’ proxy fight over.

‘Intoxicated by our own sub growth’

Disney also said that as it will focus on getting its streaming business to profitability by the end of 2024, it would no longer give guidance on its subscriber numbers and instead focus on revenue.

“We got maybe intoxicated by our own sub growth,” Iger said Thursday, noting the low price point of $6.99 that Disney+ entered the market with.

On Thursday, Iger said the company had “pricing leverage” for its streaming strategy.

Disney reported this week that its direct-to-consumer business had once again posted an operating loss for its most recent quarter. “We’re still losing money on streaming,” Iger said Thursday. “We need to turn that around.”

Media executives have begun increasing the cost of streaming services in an effort to grow profit. Disney’s recent price hike likely led to the loss of about 2.4 million Disney+ customers during the quarter.

Disney announced this week it would lean into its franchise strength with sequels to fan-favorite films like “Frozen” and “Toy Story.” Iger said Thursday that general entertainment, particularly on pay TV and streaming, wasn’t a “differentiator.”

In addition to Disney+ and ESPN+, Disney also runs Hulu and has until 2024 to buy Comcast’s 33% stake in the streaming service to take full control over it. Whether Disney will acquire the stake remains a question.

“Everything is on the table right now,” Iger said Thursday. He added that leverage isn’t currently a concern for Disney, although the company is “intent on reducing our debt over time.”

Shares of Disney rose Thursday following the restructuring announcement and the company’s earnings report.

Disclosure: Comcast is the parent company of NBCUniversal, which owns CNBC.